What is wrong with the current financial and banking system?

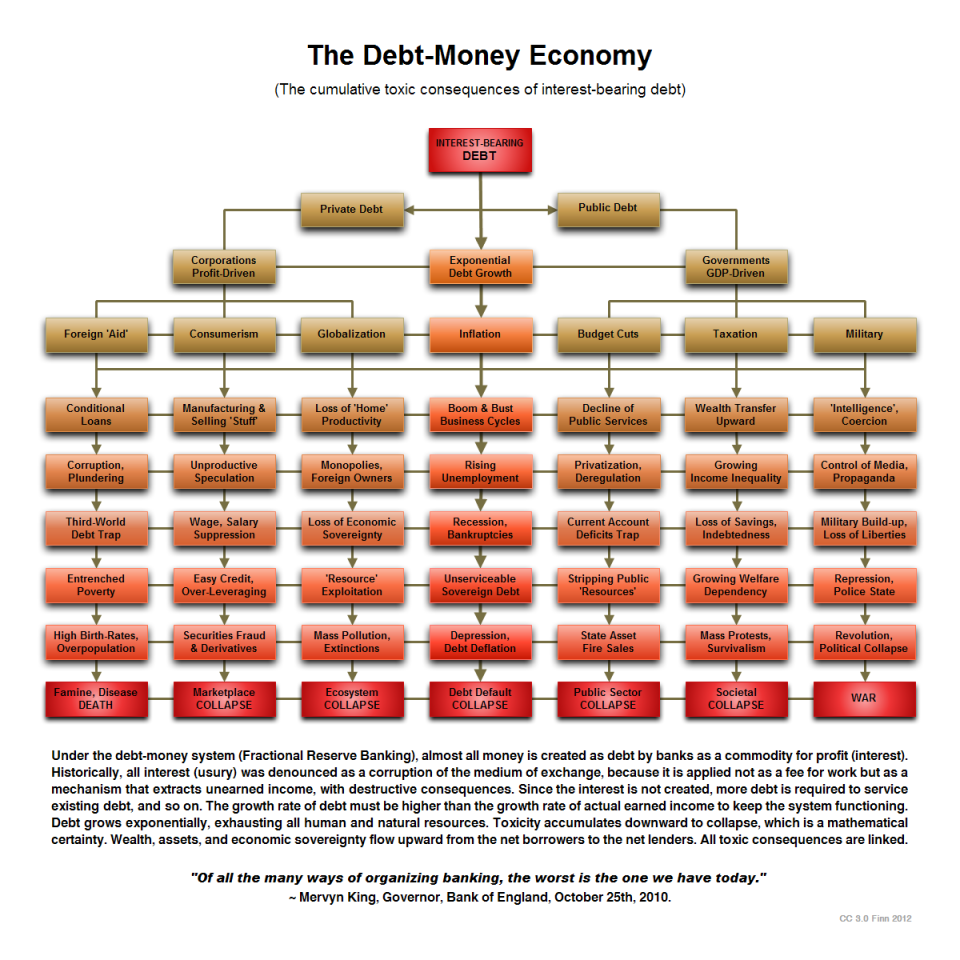

Here is the problem:

The present monetary system ensures a rapidly widening income gap. It is literally enslaving us with debt.

The banking system is inherently unstable and actually creates the recessions that results in an increase in unemployment, and destroys otherwise-sound businesses.

The financial system that is enslaving us gets its power from our consent!

The vast majority of money is created by private-sector banks.

Each time a bank makes a loan, it essentially creates money as debt.

This system results in problems such as increasing levels of household debt and inflating property prices.

The McKinsey Institute says global debt is now $199 trillion and unsustainable. (May 2015)

That means that total global debt is $27,204 for every person living today.

Watch this series of videos on the financial issues that are destroying our county, and our world:

1. Bankers Create Money out of Nothing

A four minute New Zealand video that presents the basic issue

2. Why Are House Prices so High?

This is a 2 minute UK video, and outlines the basic problem behind property prices in NZ.

3. The Future of Finance

What will banks of the 21st century look like? Well not like you think! According to Prof Jem Bendell, we need to rethink the concept of banks and currencies for a more sustainable 21st century.

4. The Biggest Scam in the History Of Mankind – Episode 4 The Hidden Secrets of Money

5. Four Horsemen is an award winning independent feature documentary. Rather than condemning bankers, politicians or the media, Four Horsemen feature documentary puts the entire system up for discussion.

And the solutions?

* The Awareness Party will put the creation of money back in the hands of the government, and not with private banks as it is now. The creation of money as debt with interest charged on it will cease, thus ending several problems with the economy. A Currency Creation Committee would be established by law, to decide the quantity of new money for the government to create. This system is called a Sovereign Money System.

* Inflation will be controlled by varying the amounts of money created. This will be more effective than the blunt tool of controlling interest rates that is used at present.

* The stranglehold of the banks would also be reduced by supporting local business, local initiatives, and co-operatively owned businesses.

* We will provide an adequate living wage – spurring the economy by putting more money in the hands of the people. (There are countries that have both strong wages and strong economies.)

* We would institute a Universal Basic Income (UBI)

* These changes are expected to put more money into the real economy, lessen inequality, and reduce the upward pressure on house prices.

* The Open Bank Resolution (OBR) would be repealed, reducing the likelihood of bank shareholders and creditors shouldering the losses of a failing private bank. People’s ordinary transaction accounts will be safe, and no longer exposed to bank failure.

* While there will ultimately be less need for taxation, we have listed some essential taxes on the Home page.

*Iceland’s government is already working on introducing a similar system.

.The key to the entire Iceland proposal is that the central bank is a state-owned bank, as is our Reserve Bank.

“A move to such a Sovereign Money System is not at all difficult technically. It requires only political will of governments to act in the interests of their citizens.” See Here

Our solutions are formally presented in Chapter 5 of the Visionary Constitution.

See also “Not Another Political Party – Why do we need one”?

The Positive Money organisation has written in detail about the 9 benefits of the Sovereign Money System, which is what our reforms are based on. The UK Green Party have also based their monetary policy on this system.

“Of all the ways of organising banking, the worst is the one we have today.”

Mervyn King, Governor, Bank of England, October 25 2010